Sprint – T-Mobile Merger

Is it

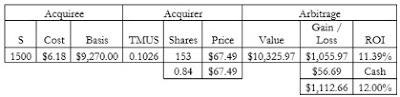

time to jump on the Arbitrage train with the Sprint – T-Mobile merger? With the

current market prices (as of 11-28-18 pre-market) sitting at $6.18 and $67.49

respectively, there is an 11.39% upside in this deal (12% when fractional

shares are paid out in cash).

There is

always risk associated with mergers and acquisition, but if an investor waits

until there is more clarity and certainty, the gains made can become a good

source of passive income. The recent mergers between Rockwell Collins (COL) and

United Technologies (UTX) have proven that getting in at the right moment can

be very lucrative for an investor.

Due to

the beat-down of stocks in October, COL had dropped to $131 and change on a

$140 per share merger valuation. An investor buying at the $131 price gained

over $8 per share recently when the final approval was received from China and

the COL shot up to over $141 per share, which was higher than the merger

valuation.

Another

similar merger is taking place right now with SCANA Corp. (SCG) and Dominion

(D) where, recognizing the depressed stock price of SCG in October, an investor

could have purchased shares of SCG for $36 and change on a $56 per share merger

valuation.

Now one

must ask the question “Is the T-Mobile / Sprint merger worth entering?” The

terms of the all-stock transaction state that for every one share of Sprint

held, the investor will receive 0.1026 of a share of T-Mobile. So long as the

stock price of T-Mobile remains 10x the stock price of Sprint, there will be a

10% upside to the buy. If that gap widens, the arbitrage realized could be

greater than 12%.

If

Albert Einstein is correct that “Compound interest is the eighth wonder of the

world,” then arbitrage is the ninth! ...and you can quote me on that. In a

recent post I wrote about the options presented to investors concerning this

merger (https://www.linkedin.com/pulse/t-mobile-sprint-merger-unlock-value-ken-rupert/). Now that this merger is

beginning to show some steam, I think it is time for investors to consider the

upside potential.

With the

T-Mobile / Sprint merger could close faster than expected. Although the target

for closing the deal is Q2-19, it is possible that the timeline for closure

could be accelerated to Q1-19. The last hurdle are depositions with the DOJ,

which are expected to be complete in mid-December. With that timeline, it is

more likely to close in Q2 but if final approvals are received quicker, Q1

might be realistic.

Before

the deal can be finalized, it will have to be approved by the Justice

Department, which will review it for antitrust violations. Mark my words, on

the day that the DOJ grants approval, there will be a seismic shift in stock

prices. In the case of COL-UTX merger, when the final approval was received

from China, COL shot up to the merger valuation and more. Announcements of

final approval are equivalent to an adrenaline shot for a tired body.

So when

should an Investor make the move to purchase Sprint? Again, so long as the

stock price of T-Mobile remains 10x that of Sprint, there is money to be made.

If that spread shrinks, the opportunity will begin dry up. Of course, once an

investor purchases Sprint shares, the spread must remain for the arbitrage to

remain intact.

It is

important to understand that there are three ways for the spread to shrink. The

first being that the share price of Sprint increase and the share price of

T-Mobile stagnates. The second is the share price of T-Mobile decreases and the

share price of Sprint stagnates. The worst case scenario is that Sprint’s share

price increases and T-Mobile’s share price decreases (unless at that time, an

investor is holding Sprint stock, which can be sold on the spread shrinkage

given the third scenario).

An arbitrageur

is trying to capture the spread between the trading price of a stock and the

true value of that stock. In the case of mergers and acquisitions, that spread

is between the trading price and the merger valuation (the price being paid for

the Acquiree).

I spend

countless hours studying mergers and acquisitions, analyzing the spreads,

monitoring the approval process, and calculating the timing. Taking advantage

of the arbitrage created by these corporate actions is as much of an art as it

is technical analysis. However, I have a few rules I follow as new mergers and

acquisitions are announced:

First,

buying on rumors creates too much risk: You have to keep in mind that mergers

and acquisitions can take up to 24 months to close (something I will touch on

later). There are so many adverse developments that can shut down M&A

activity. A geo-political event, foreign regulators, or an economic down-turn.

I never buy on the rumor.

Next,

give the merger or acquisition time to settle out after it has been announced. Typically,

when a merger is announced, the market reacts in one or two ways. If the market

likes the merger, the acquiree’s stock will spike to near the merger valuation.

If the market does not like the merger, the acquirer’s stock will drop precipitously.

I never buy into a merger or acquisition on the announcement.

Finally,

wait for an appropriate opportunity to open a position in the Acquiree. As the

merger or acquisition goes through the process of attaining approvals from the

boards, shareholders, and the government, the market continues to respond to

economic news, geo-political events, and other market drivers.

That is

what happened in October and the beginning of November. That is why COL dropped

to $131 and change leaving a double-digit arbitrage play. The same thing has

happened to the SCG – D acquisition. And now it looks like the Sprint and

T-Mobile merger is in the same position. Investors have undervalued Sprint and

as T-Mobile’s stock price continues to inch up, the arbitrage play is growing.

When a

merger or acquisition is announced, it usually requires multiple approvals and

at least 18 to 24 months of transition before the deal closes. The early days

of a merger or acquisition can make a stock bounce, but eventually it settles

back down and thus begins the clock on arbitrage. I have a time target in which

I will open a position in a merger or acquisition.

Is the

time right for an investor to open a position in Sprint? I do not know about

you, but for this investor, based on the rules, the Sprint / T-Mobile merger is

near the sweet spot.

Arbitrage.

I don’t know… I just like saying that word.

No comments:

Post a Comment